David Andolfatto on Twitter: "Would be good to know if falling commodity prices due to increased commodity supply or lower commodity demand. Either way, pattern suggests inflation likely to moderate. https://t.co/edFtqVXxFo" /

ISABELNET on Twitter: "📌 Commodities Commodity prices have surged as the global economy recovers 👉 https://t.co/cfI2vYzdeO h/t @FT #markets # commodities #commodity #economy #investing https://t.co/8CHyEpph3g" / Twitter

Linda P. Jones on Twitter: "🧵I just reviewed the Digital Commodity Exchange Act #DCEA and two things jumped out at me. 1) It says it permits "trading in only digital commodities that

Charlie Bilello on Twitter: "The CRB Commodity Index is at its lowest level since September 1972, down 75% from its 2008 high. $CRB https://t.co/ekAZ77um4E" / Twitter

True Insights on Twitter: "The Bloomberg Commodity Index is heading for new highs driven by #energy prices. What is your position, and did you change that in recent weeks as the odds

Javier Blas on Twitter: "CHART OF THE DAY: The Bloomberg Commodity Spot index, a basket of 23 raw materials from oil to wheat and aluminium, has surged to a fresh all-time high,

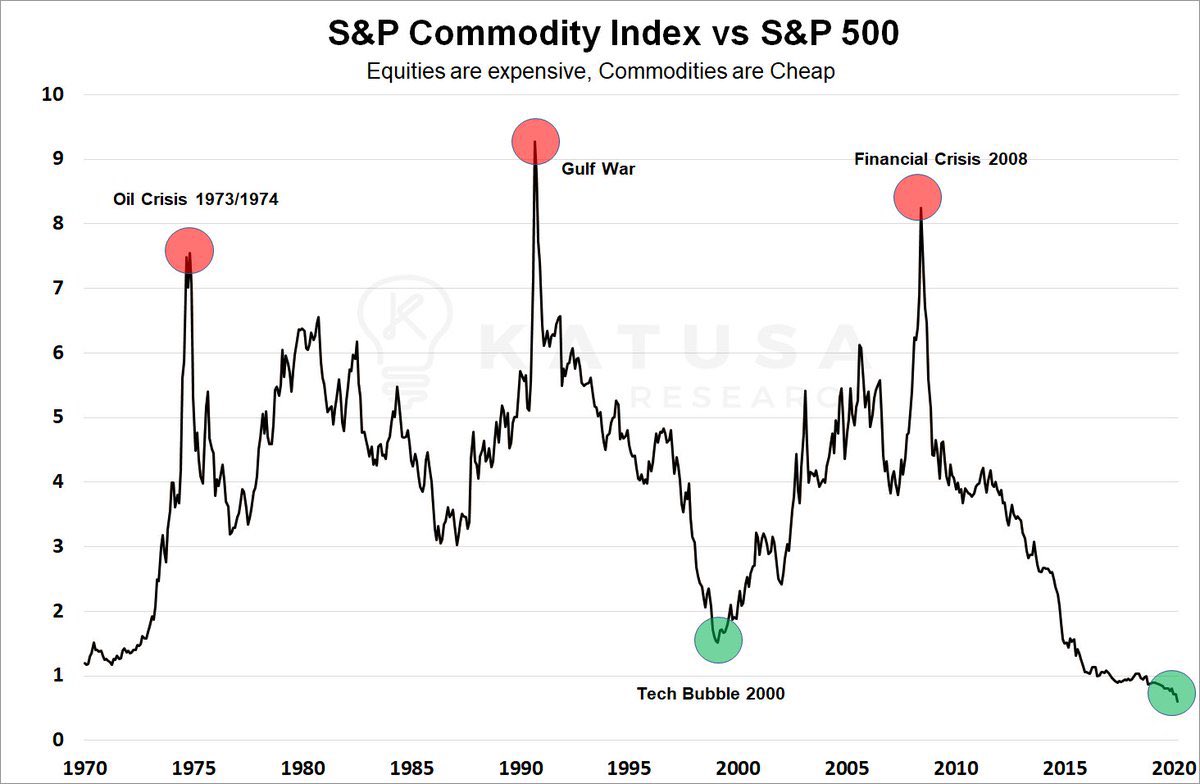

jeroen blokland on Twitter: "#Commodities vs #equities! Chart via @crescatkevin https://t.co/eOzcYv6WlD" / Twitter

Jim Bianco biancoresearch.eth on Twitter: "The CRB Raw Industrial Spot Index just made a new all-time high yesterday. (This is considered the commodity index that best reflects input prices) And the Bloomberg

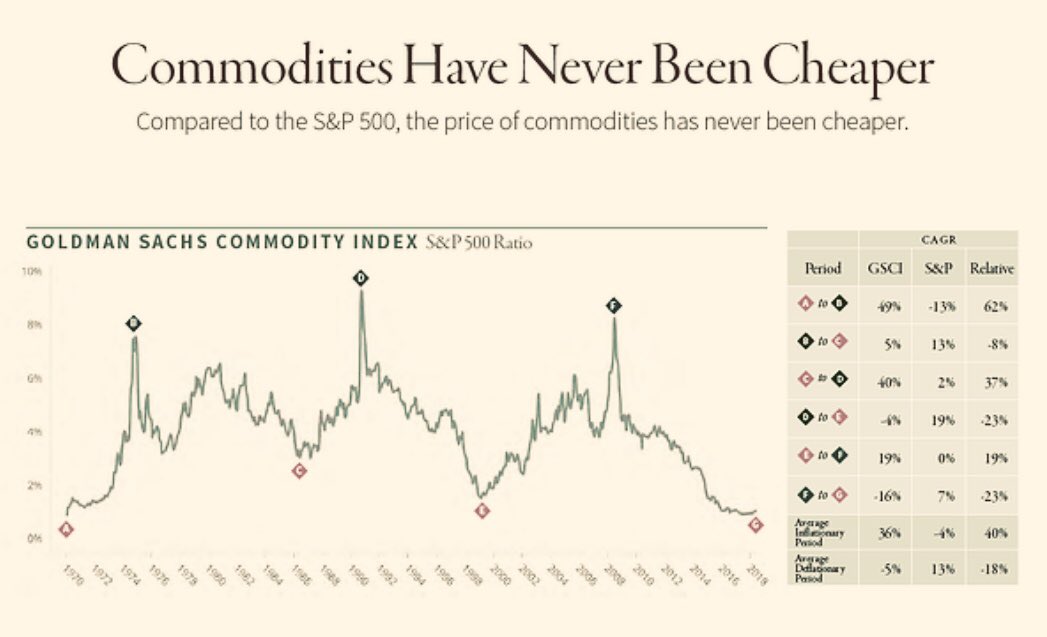

AnthonyCFA on Twitter: "#Futures $CRB #OATT #Commodities vs $SPY 👀 “Measuring commodity prices vs. S&P 500 shows that we are approaching a 100-year low valuation. The only other periods that have approached

True Insights on Twitter: "Bloomberg Commodity Index making new highs. https://t.co/5ZGjdqvYuC" / Twitter

Jurrien Timmer on Twitter: "How long can this commodities boom last? Here we see the current move in crude oil, nickel, and wheat, against a composite of 250 years' worth of commodity

jeroen blokland on Twitter: "10-year rolling #commodity returns are the lowest since 1924! https://t.co/oDpfJknPU0" / Twitter

David Beckworth on Twitter: "Note that headline CPI closely tracks commodity prices. Consequently, there are two solutions to this high inflation: (1) the Fed preemptively tightens and potentially stalls the recovery or (

ISABELNET on Twitter: "📌 Commodities The commodity price shock on consumers is not yet at the level of the 1970s 👉 https://t.co/blMxcoFA78 h/t @GoldmanSachs #markets #commodity #commodities #inflation #cpi #consumers #consumer #spending #

Grant Hawkridge on Twitter: "After 18 months of a sideways mess... the last 4 months, we have seen the trend change, and now commodities are outperforming stocks... Is this just the beginning

Liz Ann Sonders on Twitter: "Commodity boom not helping emerging markets' stock performance this time … Bloomberg Commodity Spot Index has spiked but emerging markets have struggled relative to U.S. equities [Past

Kevin Bambrough on Twitter: "Most important chart right now. Forget the noise and volatility. Those who make the switch to commodities and commodity related stocks will massively out perform over the next

Jurrien Timmer on Twitter: "With so much market chaos these days, commodities continue to look attractive. The chart below shows a bullish continuation pattern for the BCOM, supported by the GS commodity-sensitive

ʎllǝuuop ʇuǝɹq on Twitter: "BofA Survey shows collapsing growth expectations... And max long commodities.... an extremely aggressive stagflation bet. I doubt both views will be vindicated from here. The best cure for

Daniel Lacalle on Twitter: "I just read that commodities are "plummeting". Here is the commodity "slump" in context: https://t.co/yCDchyNaGo" / Twitter